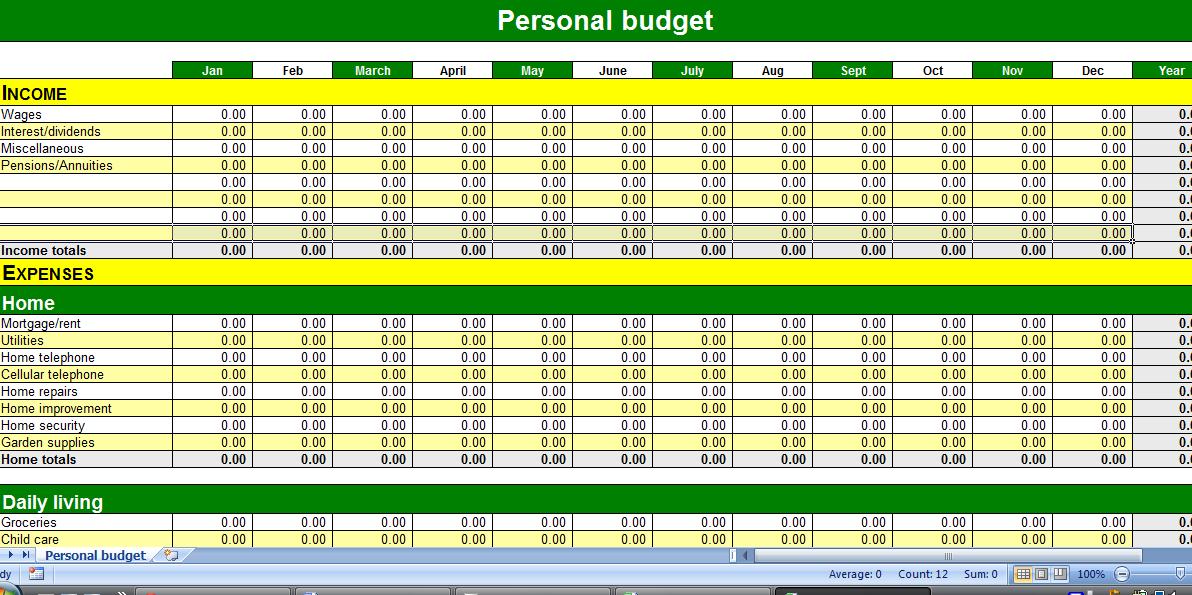

A budget can be a wonderful way to save for the future, plan for big purchases, and even spend your money just the way you want. But I’m here to let you know that a budget does not have to be limiting to be effective. The word budget is frequently associated with restricted spending. You can definitely enjoy your money while you track and manage it properly. Many people feel a budget may be a buzzkill because they think it means you can’t have any fun with your money. Otherwise, your budget may not work for you. It’s also essential to stick with your budget, paying attention to how you’re doing along the way. No matter your financial situation, whether good or bad, it’s a great idea to create a budget. In addition, knowing where your money goes or should go helps to provide a “big picture” of your financial situation and makes it easier to develop a strategy for improving where you are. To reduce your spending and manage your money successfully, you need to see where your money is going. In this guide, we will walk you through the process of creating a budget with step-by-step instructions.

#8 steps to creating a personal budget how to#

To speak with an investment expert contact us at 60 or toll-free at 1-888-Vancity (826-2489), visit your local branch or in your neighbourhood.Wondering how to create a budget as a beginner? A budget is a financial tool that helps individuals and families track their spending, plan purchases, and practice saving for the future. It doesn't factor in non-financial considerations that can result from drastic changes in spending habits. And remember, a budget is only a guideline. Once your budget is done, things are bound to change. Compare your actual expenses and income to your budget and make appropriate adjustments. Track your progressĪt the end of each month, you should re-evaluate your budget. Our Jumpstart® is specially designed for these types of savings plans.

You can set up a separate savings account for infrequent but anticipated expenses, such as property taxes, vacations, automobile insurance or car maintenance. When you pay yourself first you simply set aside a certain amount of money each month to go into an account that you will not touch. Once you've figured out how much money is coming in and where it's going, you can put together a plan that matches your goals with your financial situation. Or they can be short-term goals such as home improvements or car maintenance. These can be long-term goals like purchasing property or funding your retirement.

Set goalsĮstablish a list of the goals you wish to achieve. Once you see your spending patterns, you may be able to make adjustments to certain expenses. If your records aren't clear, consider keeping a financial diary to track your spending.īe sure to separate the fixed expenses that you must meet (mortgage, rent, car payments, insurance) from variable expenses (food, clothing, entertainment, charitable gifts). Next you need to determine how you spend your money by reviewing your financial records. This might be investment income, government assistance, student loans, employment income, disability benefits, retirement pensions or money from other sources. The first step is to calculate how much money you have coming in each month. If you're ready to roll up your sleeves and crunch some numbers, here are six steps to get you on your way. And it will even help you spot areas where you can save some money.

While there are more exciting things to do in life, a budget is still the best way for you to get a handle on ways to save money. Let's face it, doing a household budget can be pretty dull.

0 kommentar(er)

0 kommentar(er)